IRS Penalties and Interest Explained: Why Tax Balances Grow Over Time

One of the most confusing and stressful aspects of dealing with IRS tax issues is watching a balance grow, sometimes even when no new action has been taken. Many people assume this growth means their situation is getting worse quickly or that enforcement is imminent.

However, in most cases, what’s happening is far more procedural than it appears. This article explains how IRS penalties and interest work at a high level, why they exist, and why balances often increase over time. The goal is understanding – not calculation, prediction, or instruction.

What IRS Penalties and Interest Are

Although they often appear together on IRS notices, penalties and interest are not the same thing. Understanding the distinction helps clarify why balances change over time. Penalties are additional charges the IRS applies when certain tax obligations are not met. They are tied to specific situations, such as filing late or paying late, and are intended to encourage timely compliance across the tax system.

Penalties are not judgments about intent or character – they are administrative consequences applied under defined rules. Interest, on the other hand, is a charge for the time value of unpaid tax. It applies to outstanding balances in a similar way to interest on other forms of debt. Interest is generally applied automatically once a balance exists and continues to accrue while that balance remains unpaid.

Together, penalties and interest serve to encourage timely filing and payment, compensate for delayed tax payments, and create consistency across millions of tax accounts. They are part of the IRS’s administrative framework, not a signal of enforcement or wrongdoing.

Why People Receive Penalties and Interest

Penalties and interest appear on tax accounts for various reasons, most of which are procedural rather than punitive. The most common situations involve timing and compliance issues. Failure to file penalties generally apply when a required tax return is not filed by the deadline. This penalty relates to the act of filing itself, separate from whether payment is made.

Failure to pay penalties apply when a tax balance is not paid by the due date, even if a return was filed on time – filing and paying are treated as separate obligations. Accuracy-related penalties can apply when the IRS determines that information on a return was significantly incorrect, such as underreporting income or claiming improper deductions. This category covers a range of situations and does not automatically imply intentional misconduct.

Interest begins accruing when tax is not paid by its due date and continues until the balance is paid in full. These charges are applied through administrative rules and processes, not through individual judgment or evaluation.

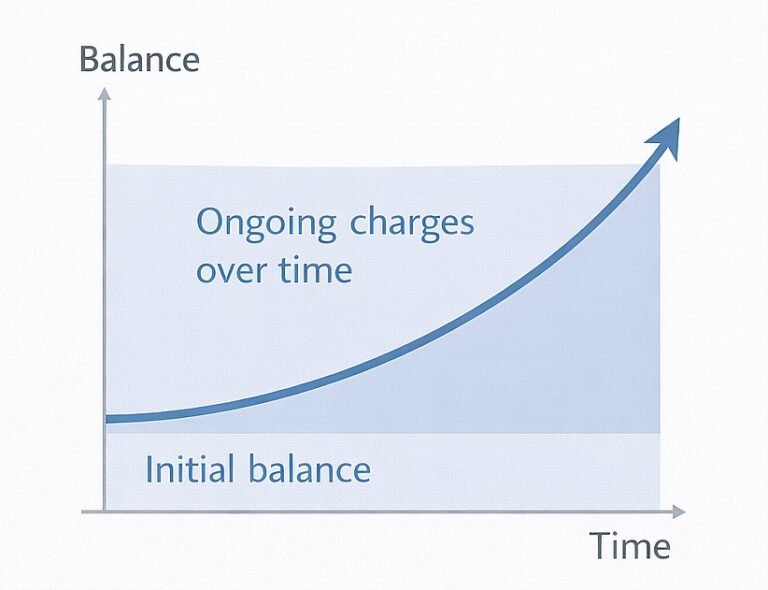

How Penalties and Interest Accumulate Over Time

A key source of confusion is that penalties and interest accrue over time, not just at the moment a notice is issued. This means a balance can increase even without new IRS action, multiple penalties may apply simultaneously, and interest continues to accrue while a balance remains unresolved. Because these charges accumulate gradually, the passage of time itself often explains why balances appear to grow unexpectedly.

This is a structural feature of the system, not a sudden escalation. For example, someone who filed a return showing a balance due but couldn’t pay immediately would see interest accruing from the original due date. If they also filed late, failure to file penalties would apply in addition to failure to pay penalties. Each of these charges continues to grow according to its own calculation until the underlying balance is addressed.

The result is that a balance from several months or years ago can be substantially larger than the original tax amount, even if no new assessments have been made.

Why Tax Balances Can Feel Unpredictable

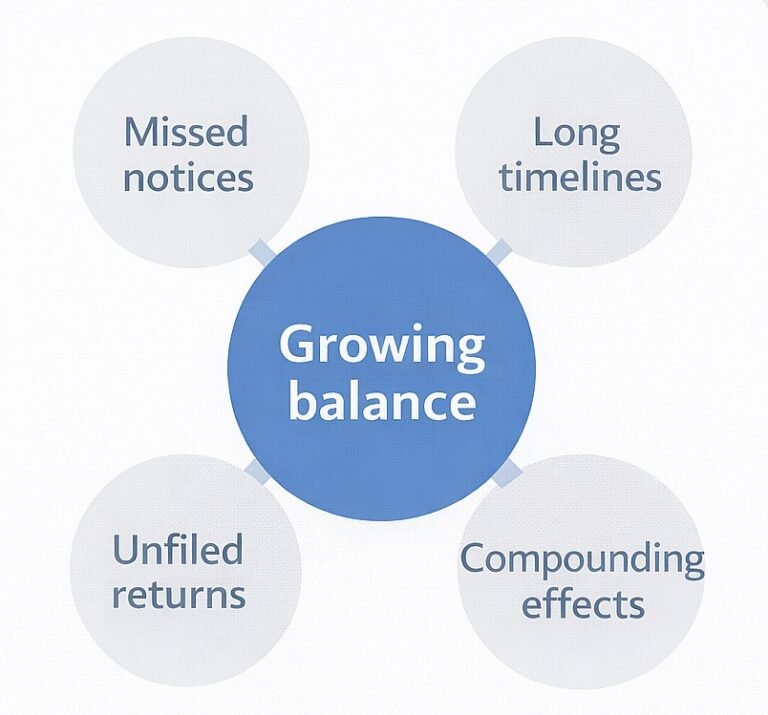

Many people describe IRS balances as feeling unpredictable or overwhelming. Several common factors contribute to this perception. Missed or unopened notices create confusion – IRS notices are often sent over long periods, and if earlier letters are missed or misunderstood, later balances can feel surprising or disconnected from their origin.

Unfiled returns can mask the true picture -when returns are not filed, balances may not be fully defined for long periods, and once filing issues are resolved, accumulated penalties and interest can suddenly become visible all at once. Long timelines compound the issue—IRS processes often unfold over months or years, and charges that accrue slowly over time can feel abrupt when viewed in a single notice.

Compounding effects make tracking difficult – penalties and interest can interact in ways that make growth harder to intuitively follow, especially without a clear timeline of events. Understanding these dynamics often helps reduce the sense that a balance is out of control, even if the amount itself is still concerning.

What Penalties and Interest Typically Affect

Penalties and interest affect the total amount owed but don’t directly trigger specific IRS actions. Their presence on an account doesn’t automatically lead to enforcement. However, they do have several practical effects. They increase the overall balance that must eventually be addressed, whether through payment, payment arrangements, or other resolution. They continue to grow as long as the underlying tax debt remains unpaid, which means delayed action generally results in larger balances.

They appear on IRS notices and account statements, sometimes making the total owed feel larger or more complex than anticipated. They factor into payment arrangements—when setting up installment agreements or other payment plans, the total balance including penalties and interest is what’s being addressed. Understanding what penalties and interest affect helps separate their administrative role from concerns about enforcement or legal consequences.

What Penalties and Interest Do Not Mean

This point is critical for context and peace of mind. Penalties and interest do not mean;

- That enforcement is happening – they can accrue without any enforcement action, and their presence alone does not indicate liens, levies, or garnishments.

- They do not mean criminal charges – most penalties and interest apply in routine civil tax matters and are not criminal accusations.

- They do not imply fraud or intentional wrongdoing. They are not personal judgments – penalties and interest are applied through automated administrative rules and do not reflect personal evaluations or assumptions about character, intent, or effort.

- They do not prevent resolution – the existence of penalties and interest doesn’t mean a tax situation can’t be addressed through payment arrangements or other means.

Many people worry that growing balances due to penalties and interest signal that their situation is beyond resolution or that serious consequences are imminent. In reality, these charges are administrative features of the tax system that apply broadly and mechanically, not indicators of special scrutiny or impending action.

How This Fits Into the IRS Process

Penalties and interest exist throughout the IRS process, from assessment through collection. When a tax return is filed showing a balance due, interest begins accruing from the original due date of the return. If the return was filed late, failure to file penalties apply. If payment isn’t made by the due date, failure to pay penalties apply.

These charges continue accumulating as the IRS process moves forward through various stages. If the IRS assesses additional tax through a notice like CP2000 or after an audit, penalties and interest apply to that assessed amount as well, calculated back to when the tax should have been paid. During collection, as notices progress from initial payment demands to more serious enforcement warnings, penalties and interest continue to accrue on the outstanding balance.

Understanding that penalties and interest are continuous features rather than one-time charges helps clarify why balances change between notices and why the total owed may differ from what was originally assessed.

Common Questions About IRS Penalties and Interest

Are penalties and interest the same thing?

No. Penalties are charges for not meeting specific obligations like timely filing or payment. Interest is a charge for the time value of unpaid tax. They serve different purposes but often appear together.

Do penalties and interest mean my case is serious?

Not necessarily. They are routine administrative charges that apply to many tax situations. Their presence doesn’t indicate enforcement action or criminal issues.

Can penalties and interest be removed?

Sometimes. The IRS has processes for penalty abatement under certain circumstances, such as reasonable cause for late filing or first-time penalty relief. Interest abatement is much more limited and generally only applies in specific situations

Why does my balance keep growing even though I haven't received new notices?

Penalties and interest accrue over time, not just when notices are sent. The balance continues to grow while the underlying tax remains unpaid, even between IRS communications.

Does paying some of my balance stop penalties and interest?

Partial payments reduce the principal balance on which interest is calculated, which can slow growth. However, charges continue on any remaining unpaid balance.

Are penalties and interest included in payment arrangements?

Yes. When setting up installment agreements or other payment plans, the total amount including accumulated penalties and interest is what’s being addressed.

How long do penalties and interest continue?

Generally until the underlying tax balance is paid in full or otherwise resolved. Interest continues as long as any tax remains unpaid.

What Options People Typically Consider at This Stage

When dealing with penalties and interest, people often evaluate several factors. Many consider whether to address the underlying balance sooner to prevent further accumulation, weighing this against current financial capacity. Some look into whether they might qualify for penalty relief, particularly if they have reasonable cause for late filing or payment, or if this is their first penalty.

Others focus on understanding how much of their total balance is original tax versus penalties and interest, which helps clarify the situation. People often think about whether payment arrangements would stop or slow the growth of their balance, understanding that while interest continues to accrue, having a structured payment plan can provide clarity and prevent enforcement.

Some evaluate whether to prioritize paying down the principal tax amount or whether the IRS applies payments in a specific order. These considerations vary based on individual circumstances, the amount owed, and how long the balance has been outstanding.

When This Situation Often Leads to Seeking Help

People often seek help or clarification regarding penalties and interest when certain factors are present. Rapidly growing balances commonly prompt this – when someone sees their debt increasing substantially due to accumulated charges, they often want professional perspective on options for addressing it. Confusion about calculations leads many to seek help – understanding exactly how penalties and interest are calculated can be complex, and people sometimes want verification that charges are correct.

Large penalty amounts often trigger consultation – if penalties represent a significant portion of the total balance, people may want help exploring whether penalty relief might be available. Multiple tax years with accumulated penalties and interest can feel overwhelming, prompting people to seek guidance on the best approach to resolution.

Those who’ve received notices showing balances much larger than expected due to penalties and interest sometimes want help understanding what happened and what options exist. The decision to seek help varies based on individual comfort with complexity and the specific circumstances of the situation.

Key Takeaways

- Penalties and interest are administrative charges that serve different purposes but often appear together on IRS notices

- They accrue over time continuously, not just when notices are sent, which explains why balances grow even without new IRS action

- Their presence does not mean enforcement is happening, criminal charges are involved, or that personal judgment has been made

- Penalties relate to specific compliance issues like late filing or payment, while interest compensates for the time value of unpaid tax

- Understanding how penalties and interest work can reduce unnecessary concern while clarifying why balances change over time

This page provides general informational content only and is not affiliated with the IRS or any government agency.