Common IRS Notice Mistakes People Make

Many IRS tax problems don’t escalate because of deliberate action or bad intent. Instead, they often become more complicated due to common, human reactions to confusing or stressful situations. Most people who receive IRS notices have never dealt with them before, don’t understand how the process works, and feel anxious or overwhelmed.

This article explains behavioral patterns people frequently experience after receiving IRS notices – not legal mistakes, and not moral failures. Understanding these patterns helps explain why some situations worsen over time, even when people are trying to cope.

What IRS Notice Mistakes Generally Are

When we talk about IRS notice mistakes, we’re referring to common behavioral responses to tax correspondence rather than legal violations or intentional wrongdoing. These are the typical ways people react to IRS notices that can unintentionally contribute to situations becoming more complicated. These mistakes include misunderstanding what notices mean, not knowing what action is needed, delaying response due to fear or confusion, or making assumptions about what silence or inaction means.

These responses happen across all income levels, professions, and backgrounds. They’re normal human reactions to bureaucratic processes that feel unfamiliar and stressful. The term “mistake” here doesn’t imply moral judgment – it describes patterns that often contribute to situations taking longer to resolve or becoming more complex than they might have otherwise.

Once filed, the NFTL becomes part of public records, typically recorded with the clerk of court or recorder of deeds in the county where you live or own property. It notifies creditors, potential buyers, and financial institutions that the IRS has a claim against your assets. The lien attaches to all your property and rights to property, both current and future – if you acquire new assets after the lien is filed, the lien automatically attaches to them as well.

Unlike a levy, which is the actual seizure of property, a lien is a legal claim that remains in place until the tax debt is paid in full or the lien is otherwise released. The NFTL gives the IRS priority over most other creditors if you sell property or go through bankruptcy.

Common Patterns People Experience

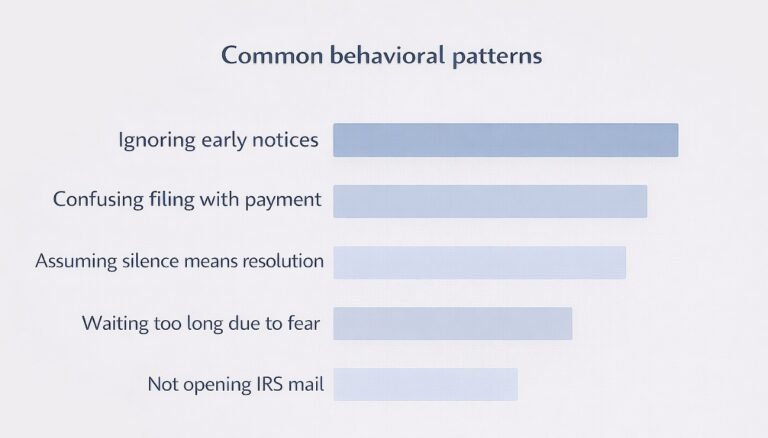

Several specific patterns appear frequently. Many people delay opening or reading early notices because they don’t feel immediately urgent. Early IRS notices are often informational in tone and may not convey urgency. Some people set them aside to deal with later, but unanswered notices lead to follow-up letters that feel more serious.

Another common pattern involves confusing filing with payment. Many assume these are the same obligation or that you shouldn’t file if you can’t pay. Some delay filing specifically because they can’t pay, not realizing filing without paying is generally better than not filing at all. Assuming silence means resolution is frequent.

When no new letters arrive for a period, some people assume the issue may have resolved itself. In reality, IRS timelines often include long gaps between notices due to processing cycles. Silence reflects processing delays rather than resolution, making later correspondence feel sudden. Waiting too long due to fear or uncertainty is common.

Concern about making things worse can paradoxically lead to inaction. Some people worry that contacting the IRS might trigger scrutiny or that engaging might accelerate consequences, making doing nothing feel safer.

How These Patterns Typically Affect Situations

These patterns don’t directly cause IRS enforcement actions, but they influence how long issues remain unresolved. When notices go unanswered, the IRS continues its process of communication and escalation. Additional notices arrive over time, each typically more urgent in tone. Delays allow more time for penalties and interest to accumulate, increasing the total owed. The passage of time without resolution can move a case through different stages of the collection process, from initial notices to final warnings to establishment of enforcement authority.

Response options and rights available earlier may narrow or expire. For example, the 30-day window to request a Collection Due Process hearing only exists for 30 days – if that notice goes unread, that right is lost. What starts as a straightforward situation can become more complex when unaddressed for an extended period. These outcomes result from timing and process moving forward, not sudden IRS decisions.

How This Fits Into the IRS Process

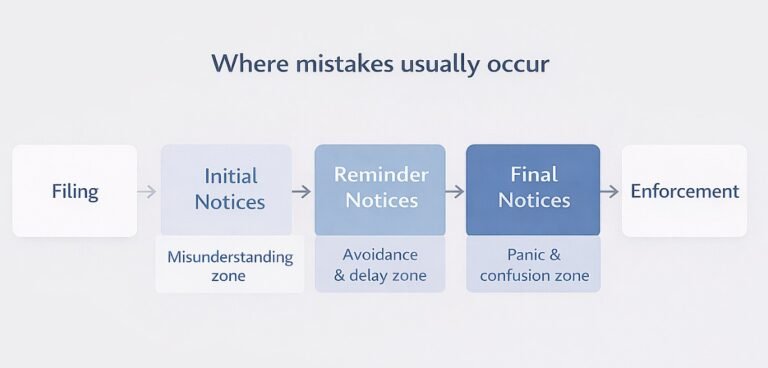

These common mistakes can occur at any stage. In the early assessment stage, the most common patterns involve not reading notices carefully, confusing filing with payment, and assuming early informational letters don’t require response. During the middle collection stage with escalating reminders, assuming silence means resolution becomes more common, as does waiting due to fear.

In later stages with final notices, some people experience paralysis from overwhelm – the situation feels so serious they’re not sure where to start, leading to continued inaction. Throughout all stages, not opening IRS mail or not reading it thoroughly can occur, though it often has more serious implications as cases progress.

Common Questions About IRS Notice Mistakes

Are these mistakes illegal?

No. These are behavioral responses, not legal violations. They may affect how situations unfold, but they’re not violations of tax law.

If I've made these mistakes, does it mean I'll face enforcement?

Not necessarily. While delayed response can allow cases to progress further, many situations resolve at various stages. Making common mistakes doesn’t guarantee any particular outcome.

Can these mistakes be corrected?

Generally, yes. Situations can typically be addressed even after periods of inaction, though options may differ depending on how far the case has progressed.

Will explaining why I made these mistakes help my situation?

Circumstances can sometimes be relevant – for example, when requesting penalty abatement for reasonable cause. However, the IRS primarily focuses on resolving the current situation rather than evaluating past delays.

Are some mistakes more serious than others?

Yes. Not responding to early informational notices has different implications than not responding to final notices with specific deadlines and appeal rights.

When Mistakes Leads to Seeking Help

Recognizing these mistake patterns often prompts people to seek help. When someone realizes they’ve been making inaccurate assumptions, they often want guidance on addressing the situation properly. Accumulated periods of inaction sometimes reach a point where people recognize they need outside perspective, particularly if fear or overwhelm has been the barrier. Receipt of more serious notices after avoiding earlier ones commonly triggers the realization that help might be beneficial.

Those who’ve let fear prevent action sometimes reach out when they recognize that continued avoidance isn’t solving the problem. Multiple accumulated mistakes often feel overwhelming enough to prompt seeking professional guidance.

Key Takeaways

- Common IRS notice mistakes are behavioral patterns that happen due to fear, overwhelm, and unfamiliarity with tax processes, not intentional wrongdoing

- Frequent patterns include delaying reading notices, confusing filing with payment, assuming silence means resolution, and waiting due to uncertainty

- While these mistakes don't directly cause enforcement, they can allow situations to progress further in the collection timeline and increase accumulated penalties and interest

- These patterns are normal human responses to complex processes and don't reflect on character or intent

- Recognizing these patterns helps explain how situations developed and can be a turning point toward addressing tax issues

This page provides general informational content only and is not affiliated with the IRS or any government agency.