IRS Collection Timeline Explained: How Tax Issues Typically Progress Over Time

When people receive an IRS notice, one of the most common questions is “How did this get here?” followed closely by “What happens next?”

The IRS collection process can feel opaque and unpredictable, especially for people encountering it for the first time. In reality, most IRS tax issues follow a gradual and structured progression, not a sudden or random escalation. This article explains the typical IRS collection timeline at a high level—from filing and assessment, through notices, and into potential enforcement—so readers can understand where they are in the process and how different letters and actions fit together.

What Is The 'IRS Collection Timeline'?

The IRS collection timeline is the general sequence of events that unfolds when someone owes taxes. It’s not a rigid schedule that applies identically to everyone, but rather a typical pattern that most cases follow with significant variation in timing and specifics. The timeline begins when the IRS determines that tax is owed and continues through various stages of communication and potential enforcement until the balance is resolved.

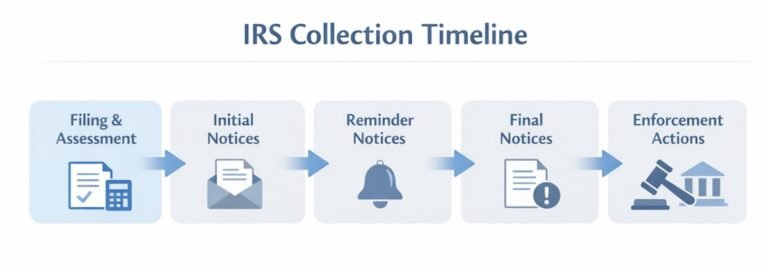

Understanding this timeline helps clarify that IRS collection is a process with distinct phases rather than a single event or sudden action. Most cases develop in stages – assessment, initial notices, escalating reminders, final warnings, and potential enforcement – though not everyone experiences every stage. Some situations resolve early through payment or arrangement, while others progress through multiple phases over months or years.

The purpose of understanding this timeline is not to predict what will happen in any specific case, but to provide context for where a particular notice or action fits in the broader process.

How People Typically Enter the Collection Timeline

People enter the IRS collection timeline through several common paths, each beginning at a slightly different point in the process. The most straightforward entry occurs when someone files a tax return showing a balance due but doesn’t pay it by the deadline. In this case, the person knows they owe, has filed their return, and the IRS begins its collection process from that known assessment.

Another common path involves the IRS proposing additional tax after comparing information returns from employers and financial institutions with what someone reported on their return. This often happens through notices like CP2000, where the person may not have realized they owed additional tax. Some people enter the timeline when the IRS assesses tax after an audit or examination that resulted in proposed changes.

Others arrive here when they haven’t filed required returns and the IRS either requests filing or eventually files a substitute return on their behalf, creating an assessment. Each of these paths represents a different starting point, but once a balance is formally assessed, the collection timeline begins to unfold in relatively similar ways.

How the Timeline Typically Progresses

The IRS collection timeline generally moves through five distinct stages, though the pace and exact sequence vary by case. Understanding these stages helps clarify where a particular notice or situation fits in the overall process.

- Stage one is filing and assessment. The collection process usually begins when the IRS makes a formal determination that tax is owed. This assessment can occur when a taxpayer files a return showing a balance due, when the IRS adjusts a return based on information it receives from employers or financial institutions, or when a return is not filed and the IRS estimates a liability. Until a balance is assessed, the IRS generally does not pursue collection activity. This is why filing, even when payment is not possible, often plays a key role early in the process.

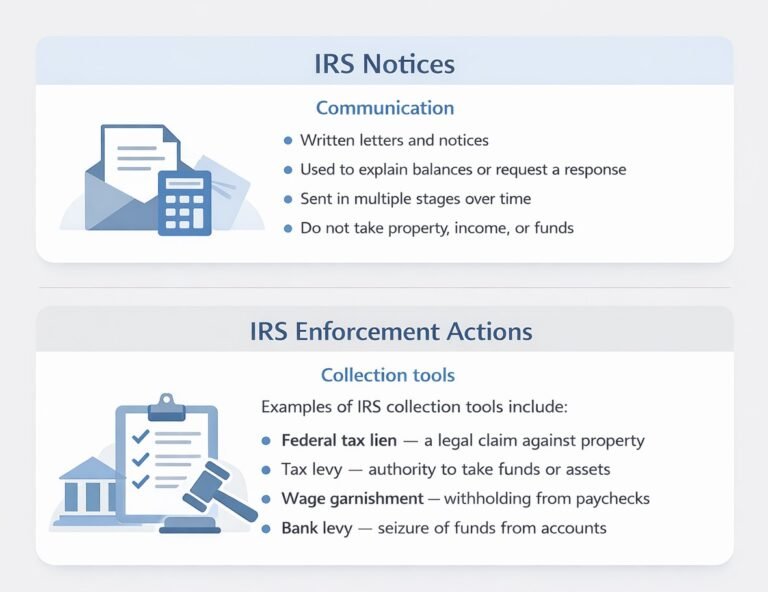

- Stage two involves initial IRS notices. Once a balance is assessed, the IRS typically begins communicating through written notices. These early notices inform the taxpayer that a balance exists, explain how much is owed, and request payment or response. Common notices at this stage include CP14, CP501, or CP503. These are primarily informational and designed to open communication. At this stage, the IRS is focused on bringing the account to resolution voluntarily.

- Stage three consists of escalating reminder notices. If the balance remains unresolved, the IRS sends additional notices over time. These escalating reminders repeat the request for payment, reference prior unanswered notices, and begin to outline potential consequences of continued inaction. The tone becomes progressively more urgent, though these middle-stage notices still focus on voluntary resolution. This is where confusion often arises—while notices may look similar, they carry different legal weight. Not every case progresses at the same pace, and gaps between notices can vary significantly.

- Stage four brings final notices and legal warnings. Later in the timeline, the IRS may issue final notices, often referred to as notices of intent. These represent a significant transition because they establish the IRS’s legal authority to pursue enforcement actions. Examples include Final Notices of Intent to Levy such as CP504 or Letter 1058. These notices often include specific appeal or response rights with deadlines. They don’t necessarily mean enforcement will happen immediately, but they mark a transition point in the process where the IRS has established its legal authority to take collection action.

- Stage five is enforcement actions. If a balance remains unresolved after required notices have been issued, the IRS may pursue enforcement. This can include filing federal tax liens, issuing levies on wages or bank accounts, or taking other collection steps. These actions are typically preceded by the required notices from stage four and are not sudden or unexpected. However, once enforcement authority is established, the IRS has broader tools available to collect the balance. Not all cases reach this stage – many resolve at earlier stages through payment, payment arrangements, or other means.

Why Collection Timelines Feel Unpredictable

Many people find IRS collection timelines confusing because they don’t progress at a uniform pace. Several factors create this variability and can make the process feel unpredictable. Whether returns are filed affects timing significantly – the IRS can’t fully assess a balance until returns are on file, so unfiled returns can create long delays followed by sudden apparent acceleration once filing occurs.

Whether the taxpayer responds to notices influences progression – responses can pause or redirect the timeline, while non-response typically leads to continued escalation. IRS system backlogs and processing delays mean that notices don’t always arrive at regular intervals. During periods of high volume or operational challenges, significant gaps can occur between communications.

Case complexity also matters – situations involving multiple tax years, business taxes, or disputed assessments often take longer to progress than straightforward cases. Prior compliance history can affect how the IRS approaches a case and what collection steps it prioritizes.

The result of all these factors is that some cases move slowly for months or even years with long gaps between notices, while others progress more quickly. This variability is normal within the IRS system but can feel arbitrary or unpredictable to those experiencing it.

What Different Notices Mean in the Timeline

Individual IRS notices represent specific points along the broader collection timeline, and understanding where a particular notice fits helps clarify what’s happening. Early-stage notices like CP14 or CP501 typically appear soon after assessment and are designed to inform and request payment. They don’t carry enforcement authority but establish that the IRS is aware of the balance and expects resolution.

Mid-stage notices like CP503 or CP504 indicate that previous notices haven’t resulted in resolution and that the case is progressing. These often reference prior correspondence and may begin mentioning consequences, though they’re still primarily communicative rather than enforcement-oriented. Final notices such as Letter 1058 or CP90 represent critical juncture points. These establish the IRS’s legal authority to levy and often trigger specific taxpayer rights, including the right to request a Collection Due Process hearing.

Collection reminder notices like LT16 may arrive after a final notice has been sent, reminding the taxpayer that enforcement authority remains in effect. Lien notices inform the taxpayer that a federal tax lien has been filed, which is a different type of action from levy but represents the IRS formally establishing its claim against property.

Looking at a single notice in isolation can be misleading—understanding where it fits in the overall sequence provides much clearer context about what’s actually happening and what typically comes next.

Common Questions About the IRS Collection Timeline

How long does the whole process typically take?

It varies significantly. Some cases progress from assessment to enforcement in several months, while others unfold over years. Factors like responses, filing compliance, and IRS processing affect timing.

Does the timeline restart if I make a payment?

Partial payments don’t typically restart the collection timeline, though they do reduce the balance. The timeline continues based on whether the full balance is resolved.

Can the timeline be paused or stopped?

Certain actions can affect progression, such as requesting a Collection Due Process hearing, setting up a payment arrangement, or qualifying for currently not collectible status. These don’t eliminate the debt but can change how collection proceeds.

What happens if I miss a deadline in a notice?

Missing deadlines can affect your rights and options. For example, not requesting a Collection Due Process hearing within the specified timeframe means losing that appeal opportunity.

How many notices will I receive before enforcement?

The number varies, but typically several notices are sent over a period of months before enforcement actions. The IRS must provide specific legal notices before taking certain enforcement steps.

Does responding to notices change the timeline?

Yes. Responses can redirect the timeline – for example, toward payment arrangements or dispute resolution – though they don’t necessarily stop it from progressing if the balance remains unresolved.

What if I need more time to decide?

The 90-day deadline is statutory and rarely extended. If you need time to gather information or consult with professionals, act quickly within the 90-day window.

What People Typically Consider at Each Stage

When trying to understand where they are in the IRS collection timeline, people often evaluate several factors. Many review all the notices they’ve received to identify which stage they’re at and whether they’ve received any final notices or warnings about enforcement authority.

People consider how long it’s been since their last IRS communication, trying to assess whether new notices are likely coming soon or whether they’re in a period of relative stability. Some think about whether they’ve missed any deadlines for responding or requesting appeals, and what rights might still be available to them. People often evaluate whether their situation is likely to progress further along the timeline or whether it might resolve at the current stage. Those who understand they’re in the earlier stages sometimes consider whether proactive action – like contacting the IRS to set up payment arrangements – might prevent progression to later stages.

People in later stages with enforcement authority established often think about what actions are most likely next and what they can do to prevent or address them. Understanding where you are in the timeline helps frame what typical next steps might be and what options are generally available at that point in the process.

When People Usually Seek Professional Help

Understanding the IRS collection timeline often prompts people to seek help or clarification at certain points. Receipt of final notices or notices mentioning enforcement frequently triggers this, as these represent critical junctures where understanding options and deadlines becomes important. People who’ve received multiple notices over time but don’t understand how they connect or what stage they’re at often seek guidance to clarify their situation.

Those facing enforcement actions or who’ve received notices about liens or levies commonly want professional perspective on what’s happening and what options exist. Confusion about what different notices mean or which ones require urgent response leads many to seek help interpreting the timeline. People with multiple tax years of issues often find the overlapping timelines confusing and want assistance understanding the overall picture. Missing deadlines for important rights like Collection Due Process hearings sometimes prompts people to seek help understanding what options remain.

Those who tried to respond to notices but didn’t receive clear communication back from the IRS sometimes seek assistance navigating the process more effectively. The decision to seek help varies based on individual circumstances and comfort with complexity.

Key Takeaways

- The IRS collection timeline is a general sequence of stages from assessment through notices to potential enforcement, not a rigid schedule

- Most cases progress through initial notices, escalating reminders, final warnings, and potentially enforcement, though timing varies widely

- Notices represent specific points in the timeline and carry different levels of urgency and legal significance

- Enforcement actions typically follow multiple prior notices and required legal warnings, not single communications

- Understanding where you are in the timeline helps clarify what typically happens next and what options are generally available at each stage

This page provides general informational content only and is not affiliated with the IRS or any government agency.